The more contagious Delta variant has contributed to a 172% increase in U.S. COVID-19 cases over the last two weeks. The spike is raising concerns some social distancing measures may be reenacted. Initial jobless claims are increasing. Last week claims jumped above 400,000 after staying below that threshold for several weeks.

Key Points for the Week

- COVID-19 cases have increased 172% in the last two weeks as the Delta variant continues to spread.

- Initial jobless claims rose back above 400,000 last week.

- Estimated S&P 500 earnings are expected to grow 74.2% based on a strong start to earnings season.

Based on current projections, S&P 500 earnings will increase 74.2% as earnings last quarter are comparing favorably to the quarter most affected by social distancing measures in 2020. Given normal earnings trends, earnings growth will likely finish even higher.

Concerns about the Delta variant pushed stocks lower last Monday, but stocks rallied the rest of the week and finished at a record high on Friday. Last week, the S&P 500 gained 2.0%. The MSCI ACWI added 1.1%, as foreign stocks trailed domestic positions. The Bloomberg BarCap Aggregate Bond Index increased 0.2%.

This week, Thursday’s U.S. gross domestic product heads a list of key economic releases that include a Federal Reserve meeting, eurozone GDP and CPI and Japanese employment.

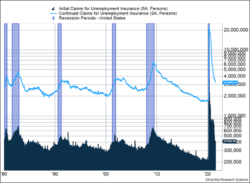

Figure 1

Four Other Items on the Rise

Last week, we detailed how inflation has been increasing because of components tied to moving around. Inflation isn’t the only key data point in an uptrend. This week’s update examines recent upward trends in COVID cases, S&P 500 earnings, initial unemployment claims and the stock market.

COVID Cases

COVID cases have been on the rise as the Delta variant has become the dominant U.S. strain. The Delta variant appears more contagious than previous variants, and vaccines seem to be less successful at stopping transmission while still effectively reducing the severity of the disease. Areas where vaccinations have lagged have contributed to the increase in cases and growing hospitalizations.

The uptick in cases could trigger additional social distancing measures and slow the recovery. If additional measures are implemented, the expected economic consequences would likely be smaller. Governments have a better idea of which social distancing measures helped stem the tide and which hurt the economy the most. Countries that have reintroduced social distancing, such as Japan and Australia, haven’t seen the same economic consequences as companies will be able to pivot toward other plans. The economic costs will increase if schools decide to reintroduce remote learning, as parents may need to work less to support children.

S&P 500 Earnings

Analysts estimated earnings would grow more than 60% in the second quarter. Based on robust reports for the first 25% of S&P 500 companies, the final growth rate could be around 80%. Earnings growth compared to last year is so strong because earnings dropped sharply during the peak periods of social distancing and are now rallying during reopening.

Initial Unemployment Claims

Initial unemployment claims jumped back above 400,000 last week after dropping below this important threshold in recent weeks. These numbers seem very high compared to the very low number of claims just before COVID. During this period, results in the low 200,000 range were common.

A longer-term evaluation, as shown in Figure 1, suggests current trends may be more normal. Figure 1 uses an adapted scale, where big increases don’t look so large and it is easier to spot differences in other periods. The data show periods of economic strength can include times when initial unemployment claims are high. The Reagan recovery during the mid-80s and again in the mid-90s both had periods when initial unemployment claims were high even though the economy wasn’t in recession.

Stocks

Despite concerns about COVID, the S&P 500 keeps moving higher. A sharp decline last Monday transformed into a four-day rally that sent the S&P 500 to new highs. Market performance has remained strong despite some obvious risks. But some markets are lagging. The MSCI ACWI Index, which is more than 50% invested in U.S. companies, is trailing the S&P 500 by 4.9% this year. Given the strength of the U.S. components, international markets are likely reflecting a slower recovery from the pandemic and may also be showing a greater wariness that these trends could be more problematic than investors in U.S. stocks realize.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.dol.gov/ui/data.pdf

https://www.nytimes.com/interactive/2021/us/covid-cases.html

https://insight.factset.com/sp-500-earnings-season-update-july-23-2021

https://www.ishares.com/us/products/239600/ishares-msci-acwi-etf

Compliance Case # 01091798