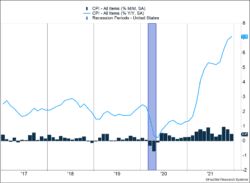

Inflation remains a challenge to the U.S. economy. CPI rose 0.5% in December and surged 7.1% during the last year. It wasn’t all food and energy prices. Core inflation, which excludes those more volatile elements, increased 0.5% as well. As the bright blue line in Figure 1 shows, inflation has reaccelerated after dipping in the third quarter.

Key Points for the Week

- CPI inflation rose 0.5% last month and increased 7.1% in 2021. Core inflation, which excludes food and energy, increased by more than 0.5% for the third consecutive month.

- U.S. retail sales fell 1.9% from the previous month, the biggest decline since February 2021. Internet sales fell 8.7% as delivery concerns moved Christmas sales to October and November.

- Uncertainty has created a wide performance gap between various market segments.

Retail sales moved in the opposite direction of inflation, falling 1.9% last month. It was the second largest drop of 2021. Much of the fall can be attributed to the Christmas shopping season concluding sooner. Internet retailers experienced an 8.7% decline relative to November. Sales were strong in October, suggesting delivery concerns moved purchases forward and October’s gains made up for December’s decline.

Stocks continued to slide lower, with some investors selling appreciated stocks in the new year. The S&P 500 index dipped 0.3% last week. The MSCI ACWI gained 0.2% as international stock markets made up for the slight decline in the U.S. The Bloomberg U.S. Aggregate Bond Index shed 0.3% as inflation readings pointed toward higher rates and the need for more compensation for bond investors bearing inflation.

Figure 1

The Drum of Inflation Keeps Beating

The inflation data is beginning to resemble the orchestral work “Bolero,” where the same notes get played over and over again and the volume keeps climbing as more instruments are added to the piece. Similar to last month, December CPI jumped 0.5%. Prices leapt 7.1% during 2021, reaching the highest levels since inflation started declining in 1982. Core inflation increased 0.5% in December and rose 5.5% for the year.

Inflation was high even though every sector wasn’t contributing. Food prices rose in line with the overall increase. Sectors benefiting from reopening or plagued with labor shortages from COVID-19 contributed to the high inflation reading. Prices for new vehicles, used vehicles, airline fares, household goods, and hotels all increased faster than the broader index. Energy prices declined last month; otherwise the overall rate would have been even higher.

Inflation challenges have become a global challenge, although they are impacting the U.S. more than other developed nations. Eurozone CPI rose 5.0% last year and reached an all-time high. Core eurozone inflation increased just 2.7%.

The data lead to two questions we will address today: Why is inflation higher in the U.S. than Europe and what factors are likely to push it lower?

A stronger economy and more stimulus are two reasons U.S. inflation has been higher than in Europe and other areas. The last U.S. employment report pegged U.S. unemployment at 3.9%. Europe’s unemployment rate is at 6.5%, and some countries, such as Spain, have double-digit unemployment. The number of people lacking work has likely slowed wage increases in these countries. Americans also received more money from the government. According to data from Statista, Europe’s aid package for the pandemic was half the size of U.S. support. More robust aid has contributed to the faster recovery in the U.S. but has also likely fueled inflation.

The U.S. has also reversed some policies that kept inflation in check. Higher tariffs on goods reduce competition and allow prices to climb. Energy prices for carbon-based fuels have increased because of demand. Supply hasn’t moved to fill the gap as quickly because projects with long life cycles may not make investment sense given our transition toward greener methods of transportation.

What will help control inflation are changes in policy and the underlying strength of disinflationary trends. Interest rates are likely to increase multiple times this year, slowing economic growth. High government debt levels have also become a concern and limit prospects for additional spending. We’ve seen reticence by some lawmakers to support more spending because of its inflationary effects.

Long-term trends also act to reduce inflation. Our nation and the world are getting older, and as people age, saving rates typically climb. Capitalism encourages companies to find ways to improve. Some of those gains accrue to the company in the form of higher profits. As more companies adopt the same methods, prices often become constrained or edge lower. When those long-term factors become strong enough, the steady beat of high inflation will likely reverse, perhaps more quickly than many expect.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.statista.com/statistics/1115276/unemployment-in-europe-by-country/

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Unemployment_statistics

https://www.statista.com/statistics/1107572/covid-19-value-g20-stimulus-packages-share-gdp/

https://www.bls.gov/news.release/cpi.nr0.htm

https://en.wikipedia.org/wiki/Bol%C3%A9ro

https://www.census.gov/retail/marts/www/marts_current.pdf

Compliance Case #01245622