Did you know that your Social Security benefits can be taxed? That’s right, as much as 85% of your Social Security benefits—money that you put away over your entire career—could be subject to taxation when you receive the benefits in retirement.

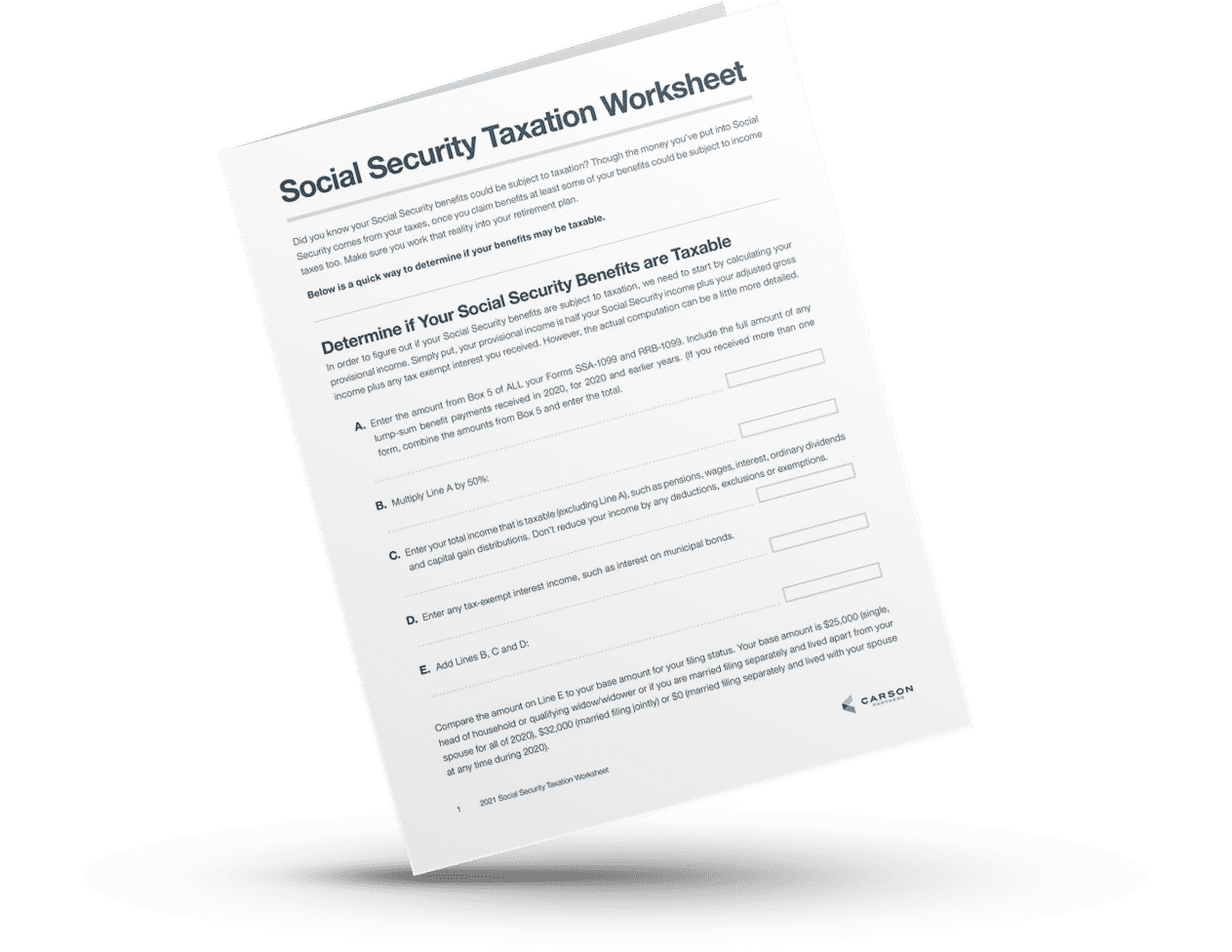

This worksheet helps you figure out if you could owe, and how much of your benefit could be taxed. The more you know, the better you can plan.