Welcome to this week’s edition of Wisdom and Wealth! You can check out the podcast and Youtube Video for this edition below! Thank you for reading, listening and watching!

This past weekend I read two thoughts from folks I’ve grown to respect which seemed to be in a sort of tension. The first thought was: “don’t try to change someone’s mind.” To this I thought “Amen!” This was closely followed by…”those poor congressional staffers!” The next thought that I came across was “Being wrong compounds forever.” This one made me cringe! Because I knew this one was right. Some mistakes we make have generational consequences and I’m not talking about just finances. Today I’d like to unpack both those statements and why they stuck with me.

Who changes your mind? Vs Who tells you what you want to hear?

The first statement of not trying to change someone’s mind, I wish I had figured out sooner in life. Very few people want to be convinced that their preferences can be “improved” or that their beliefs are not supported by the facts. If you doubt me, test this out at Thanksgiving. I’ll bet you my favorite cigar it turns out “memorably”. I’m joking a bit, but not much. The reason this idea was held in tension is because sometimes the highest value someone can provide in the financial advice industry is to go against this this piece of advice. Most financial television and cable news is designed to scare you to death and create a forced choice to retail therapy. This whole system is designed to freak someone out enough to keep them coming back day after day and sell them something. I’ve lost track of the number of times I’ve talked with someone who has seen a news story and wants to know how it affects their situation. This is most of the time only natural. But when we are scared by a market event, or a situation, we tend to move in directions that are less than helpful or efficient. Often you need someone to sit right next to you and remind you to take a breath. Sometimes it’s the person who moves the slowest and most methodical that is the most efficient and effective. Hopefully. it’s not often, but there are moments where I believe an advisor is called upon to change someone’s mind. This is why trust is so vitally important. This is why making sure you are both driven by the same first principles is critical.

The other time that I find that it’s important to work with clients and “enhance their perspective” has to do with what many call “shiny object syndrome.” Every six months there is some revolutionary potion, patent, idea, service, or elixir that is going to solve all the world’s problems and give every citizen of Lake Wobegon their wildest dreams. Don’t get me wrong, I too read and look at trends. Often sharp entrepreneurs with great ideas or solutions catch my eye. But more often than not, the belief behind the temptation towards SOS (Shiny Object Syndrome) is wanting an easier path towards independence. The reality is that the path towards independence can be a long one. Being a part of numerous companies who share their profits with you can help you move forward. It may sound boring, but Proverbs comes to life every day. “whoever gathers little by little will increase it.” If you aren’t careful, you can spend more time envying the market returns of your “neighbor” than remembering that if you simply average 5-6% returns long enough, you will be just fine. This is why those who know me know that I focus on cashflow planning so adamantly. Dividends are a beautiful thing.

Being Wrong Keeps on Compounding

The second statement of “being wrong compounds forever” stopped me in my tracks because I contemplated how that could be true in the raising of my own kids. Are there habits, blind spots or even insecurities that I have and am not aware of that are holding them or even my larger community back? I am haunted by the fact that beliefs, principles, and habits compound forever both positively and negatively. Because of this I seek to question my actions as much as I possibly can. Am I missing something? It’s often the unexamined areas of life that can bring me the most fruit. But shifting gears back to finance. It is a fact that trying to “time the market” and avoid paying the “risk premium” compounds on in the future…it’s just you don’t realize it and typically no one that I am aware of tracks that sort of thing…it’s just too painful! If you don’t believe me, don’t take my word for it.

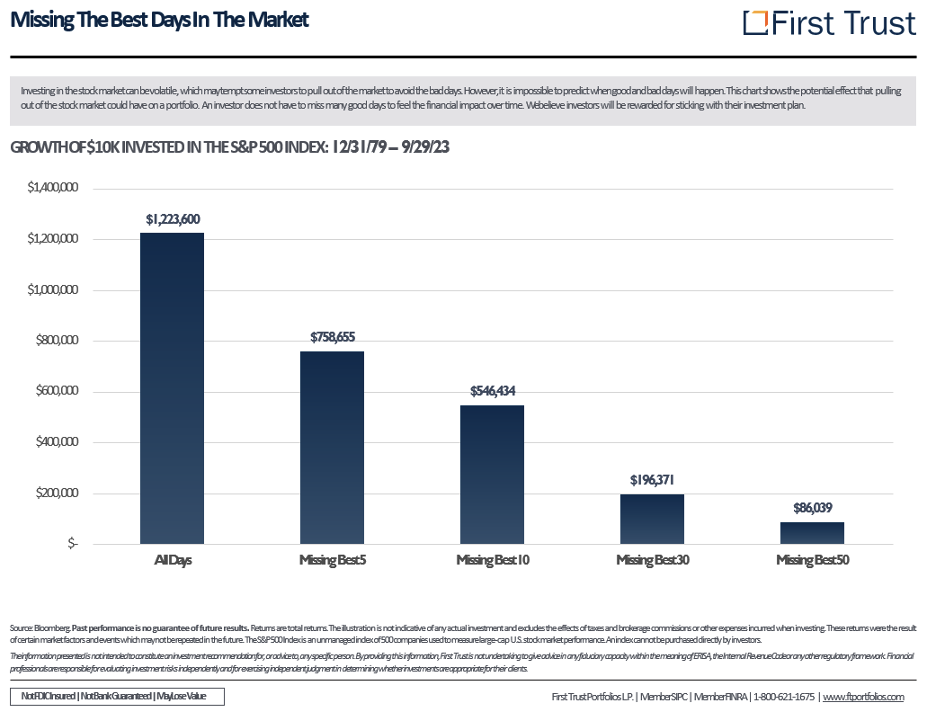

Bloomberg put out a study that tracked the movement of $10,000 invested in the S&P 500 from 1980 to present. That $10,000 turns into $1.2M dollars. BUT if you miss the five best days of the market over that period of time you had $758,655. If you missed the best 50 days of the market over that 43 year period…you ended with just $86,039.

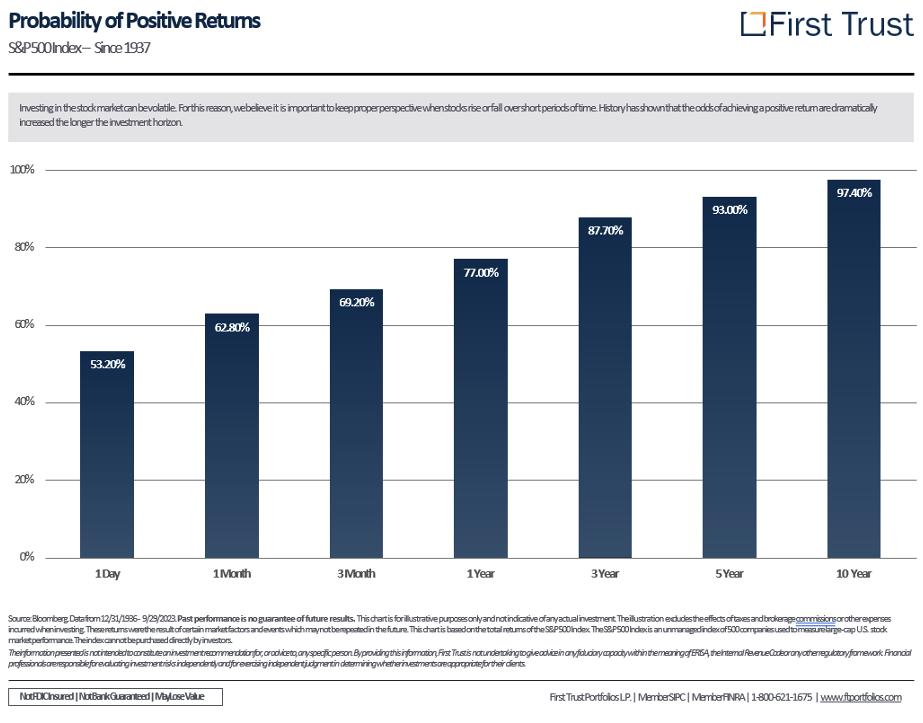

Let that sink in. Write it down and pull it out and remind yourself of it every time you are tempted to do something rash. Furthermore, remember this second piece of information. Bloomberg also did a study that from 1936-present day, your odds of achieving a positive return are over 97% when you stay invested for 10 years or longer.

This should serve as a reminder that time and discipline can be your friend or your enemy…but it is your choice whether they become friend or foe. If you have not made a financial plan, do so as soon as you possibly can. Next find someone who can hold you accountable to follow said plan. You need to provide yourself the space, time, and relationships necessary to stay focused on what is most important. If you don’t, time and your own choices can become your worst enemy.

I think I’ll leave things there for now. Thank you again for reading. Reach out with questions or comments and as always, remember that I’m wishing you and your family continued Truth, Beauty and Goodness on the road ahead!