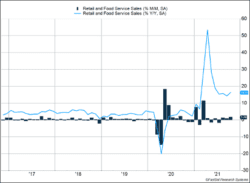

U.S. retail sales surprised economists, rising 1.7% in October (Figure 1). Rising prices contributed 1% to the growth, and increased purchases generated the remaining 0.7%. Both the top-line and after-inflation rates were higher than pre-pandemic levels. Supply chain risks may have prompted consumers to kick off Christmas shopping early at internet retailers and stores selling electronics and appliances. Those two segments contributed to the strong results.

Key Points for the Week

- U.S. retail sales rose 1.7% in October and indicated consumers are kicking off the Christmas shopping season early.

- U.S. industrial production climbed 1.6% in October as auto production rose 11% in just one month.

- Stocks climbed during a calm week for the S&P 500.

The supply chain issues seem to be improving. Industrial production rose 1.6%, with much of the increase from auto production, which rose 11% as the industry began returning to normal inventory levels.

The S&P 500 index of stocks finished a calm week with a gain of 0.4%. The biggest daily move was less than 0.4% in either direction. The global MSCI ACWI dipped 0.2%. The Bloomberg U.S. Aggregate Bond Index rallied just 0.1% after being pressured lower from increasing inflation in the U.S. Personal spending, personal income, and a second U.S. inflation reading lead this week’s data releases.

Figure 1

Early Christmas

Are Christmas lights coming out early this year? It seems more houses are decorated with lights, and you can already see trees in windows. The latest retail sales data suggest the Christmas season may be starting early as well.

October retail sales were released last Tuesday and showed consumers are continuing to spend money as spending beat expectations for the third straight month, rising 1.7%. Over the past three months, retail sales increases have averaged 1.2%, which is higher than the average pre-pandemic monthly climb of around 0.2-0.3% per month. Online sales continue to lead the way. An increase in motor vehicle and parts sales was a good sign, after sales were hampered by a semiconductor chip shortage for most of this year.

The overall increase benefited from higher-than-normal inflation. The good news is that real retail sales, which adjust for inflation, still increased 0.7% month over month and are still 10% higher than the trends observed prior to the COVID crisis.

As noted in the summary, internet retailers and electronic and appliance store sales indicate consumers are willing to spend and are more concerned about goods arriving in time for Christmas than how much they might have to pay. Stories about supply shortages are likely raising concerns among shoppers.

Even though shoppers are worried, retailers have generally indicated their inventory situation remains positive. Retailers appear to have ordered goods earlier than normal, and some larger retailers have sought to use smaller ships docking in smaller ports to move goods. Improvements in the Los Angeles / Long Beach port have slightly decreased the number of container ships waiting to dock, and shipping prices have fallen in recent weeks.

The strong results also show that higher prices aren’t keeping consumers from spending. If consumers will pay more, inflation may last for longer than expected as retailers raise prices to reflect the higher demand.

The net effect is the Christmas season looks to be in solid shape. Consumers are receiving bigger pay checks, and consumer debt seems well controlled. Initial data suggest the Christmas season should be strong.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.federalreserve.gov/releases/g17/current/default.htm

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.wsj.com/articles/supply-chain-problems-show-signs-of-easing-11637496002?mod=hp_lead_pos1

Compliance Case #01192923