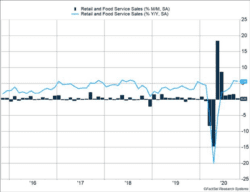

Retail data were mixed last week. U.S. retail sales rose 0.3% in October and are now 5.7% higher than one year ago. But as Figure 1 shows, the increase was the smallest since the recovery began. Increased coronavirus cases in October likely pressured purchases lower and moved consumers online. Non-store retailers reported a 3.1% increase in sales.

Key Points for the Week

- Retail sales growth slowed in response to increased coronavirus cases in October.

- Initial unemployment claims rose as outbreaks soared last week.

- Stocks gave back some of the previous week’s gains.

Initial unemployment claims bounced higher, moving up to 743,000 as the slowing sales trends in October likely extended into November and forced the layoff of workers in vulnerable industries. More people also took advantage of programs for the self-employed and long-term unemployed as the virus drags on.

The S&P 500 slid 0.7% last week amid signs of economic tightening. The MSCI ACWI Index, climbed 0.6% as global stocks have experienced some gains compared to U.S. stocks. The Bloomberg BarCap U.S. Aggregate Bond Index added 0.6% in response to economic concerns pushing interest rates lower.

One of the two vaccine producers that reported strong results in recent weeks filed a request with the FDA to allow distribution. The other company with strong results is expected to follow suit in coming weeks. New home sales, durable goods, and personal income data highlight this week’s economic releases.

We wish everyone the happiest of Thanksgivings, even in these trying times!

Figure 1

Speed Reduced Ahead

2020 has seemed like an unending road trip we never expected to take to an uncertain destination. But with the probability of multiple vaccines being approved in coming months, a destination has become imaginable. The excitement, however, is being tempered by surging virus outbreaks and an economy signaling our speed is going to be reduced over the winter.

If 2020 is a road trip, then the vehicle to represent the economy is not some fuel-efficient hybrid, but rather a semi-truck pulling a heavy load. Semi-trucks are a challenge to drive. They are hard to turn quickly and, once stopped, are difficult to get back up to speed. Our economy suffers similar challenges. Workers cannot be retrained immediately for new jobs. Once the economy slows, it takes time to regain momentum.

Based on recent data, it appears the economy is beginning to lose steam. Several states have tightened restrictions on gatherings and businesses. More are expected to follow as governments look to reduce hospitalizations from the virus. Those restrictions invariably contribute to slowing down the economy. But even without governments stepping in, surging virus outbreaks are prompting individuals to restrict some activities on their own, as the data from October show.

In October, retail and food service sales increased only 0.3% from the previous month. Expectations were for a 0.5% increase. The small increase is the lowest since the April bottom. After two strong months of rebound and three months of slightly above-average growth, the recovery stalled in October.

Digging deeper into the data only confirms the slowing trend. The categories that did best when the restrictions were steepest swung toward growth. Online spending, represented by non-store sales, rose 3.1%. Home improvement stores saw solid gains as people stuck at home took on renovations. Retailers that struggle with COVID languished in October. Clothing and clothing accessory stores experienced a 4.2% drop. The numbers in November could be worse.

Employment data confirmed the slowing trend. Initial unemployment claims from the second week of November increased 18,000 after falling most weeks. Twenty-four thousand more self-employed workers tapped Pandemic Unemployment Assistance than the previous week. At the end of October, 4.4 million unemployed people were receiving Pandemic Emergency Unemployment Compensation (PEUC), up 300,000 from the previous measurement. The PEUC supports unemployed workers whose traditional benefits have run out. The increase signifies many people are having trouble finding work after months of unemployment.

Manufacturing isn’t in any position to support the economy. Industrial production rose only 1.1% last month. The 737 Max was finally cleared to fly by the FAA, but demand for new planes is likely to remain very low until a vaccine is more widely distributed. Housing remains a bright spot as single-family housing starts rose 6.4% from the previous month. But the welcome strength in demand for homes isn’t enough to counter the slowness in other areas.

How can the economic momentum be maintained during this difficult period? Some form of government support for those who have lost jobs or whose businesses bear the challenges of COVID-19 would help. Given the probability of a vaccine, the size of the package may not be as important as the speed at which it reaches the hurting. Government aid can support spending and help pay bills until the vaccines provide a more durable form of support by allowing activities to resume.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.cnbc.com/2020/11/19/stock-market-futures-open-to-close-news.html

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.federalreserve.gov/releases/g17/current/

https://www.dol.gov/sites/dolgov/files/OPA/newsreleases/ui-claims/20202160.pdf

Compliance Case: 00881744