The Federal Reserve both met expectations and surprised investors at the same time last week. As expected, the Fed raised rates 0.25%, beginning to unwind the sharp rate reductions it implemented to protect the economy during the early stages of COVID-19. The surprise was the announced intention to raise rates six more times this year. Previously the Fed had indicated around three hikes was likely this year.

Key Points for the Week

- The Federal Reserve raised rates 0.25% and announced it expects to raise rates six more times this year.

- U.S. retail sales rose 0.3%, below expectations for a 0.4% increase. Most of the increase was due to rising prices rather than increased sales volume.

- The S&P 500 soared 6.2% as large growth stocks rebounded from recent declines.

Retail sales were weaker than in recent periods. The value of sales increased 0.3% last month, missing expectations of a 0.4% increase. Slower growth is a healthy step during inflationary times. Retail sales have risen 17.6% in the last 12 months and that rate of increase, along with a tendency to spend more on goods, has put additional pressure on inflation.

The S&P 500 rebounded from recent weakness by rallying 6.2% last week. The rally was strongest in growth stocks, which have lagged this year. The Russell 1000 Growth Index jumped 8.4% last week. The MSCI ACWI added 5.8%. The Bloomberg U.S. Aggregate Bond Index fell 0.4% as the more aggressive Fed policy pressured government bonds and mortgages. Key housing data and last month’s trade deficit are being released this week.

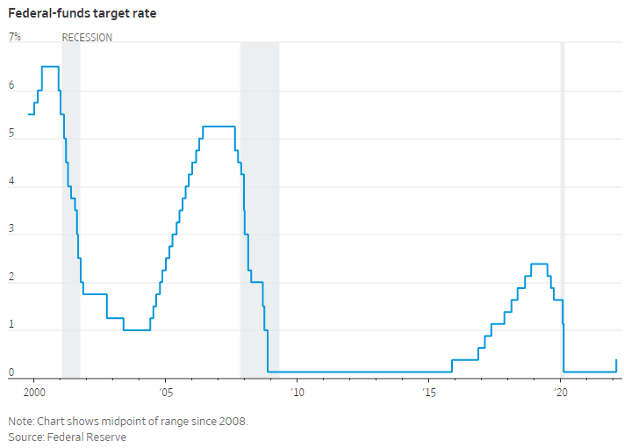

Figure 1

Meetings that Matter

People don’t like meetings. The reasons aren’t that surprising. Many argue they could be conducted by email instead or that one or two people do all the talking. Others believe meetings are often redundant and don’t decide anything. The most recent Federal Reserve meeting was on the other side of the spectrum. There were lots of strong opinions by multiple key officials, and the Fed decided to increase the target federal funds rate by 0.25%.

As Figure 1 shows, it was the first interest rate hike since December 2018. While the quarter-point increase was anticipated, the Fed also made large upward adjustments to its forward-looking projections for inflation. In December, the Fed was predicting 2022 inflation would be 2.6%. That prediction has increased to 4.3%.

It is now clear the Fed is responding to inflation concerns with changes in policy that will move markets for many months to come. It forecast an additional six quarter-point increases through the end of the year, which means the Fed is planning to raise rates by 0.25% every meeting for the rest of the year.

The increases are far more than the Fed expected a few months ago. At the meeting in December, it projected the federal funds rate would be at 0.90% at the end of 2022. Now the projection is for around 1.9%, signaling a more hawkish tone that should lessen inflation pressures while also slowing economic growth.

In addition to the rate hikes, the Fed also hinted that it is working on plans to decrease the size of its balance sheet. The balance sheet was expanded through an aggressive bond-buying program that began in 2020 because of the pandemic and only recently stopped. According to Fed estimates, the effect of this quantitative tightening should have the same effect as one additional rate hike this year. With these moves, Fed Chair Jerome Powell shows intent on controlling the inflationary pressures that we’ve been seeing, even if it comes at the cost of slowing the economy.

When the Fed increases interest rates, it directly affects short-term rates. The three-month Treasury bill is now at 0.37%, which is right between the Fed’s target for the federal funds rate of 0.25-0.5%. Long-term rates respond to rate increases but also reflect how the rate hikes will affect the economy and future Fed policy. This week, the market responded by pushing interest rates higher, mainly along the two, three, and five-year parts of the curve. The increase in rates caused some parts of the curve to invert, with the seven-year yield 0.02% higher than the 10-year Treasury yield.

The Fed wants to avoid an inverted yield curve, which is what happens when a bond yields more than other bonds with longer maturities. A miniscule difference between the seven- and 10-year bonds isn’t a big deal. The bigger focus is on periods when very short-term rates (one-year or less) are above long-term rates. In the past the economy has often moved into recession when short and long-term rates become inverted by meaningful amounts.

Reducing its holdings of intermediate and long-term bonds puts upward pressure on interest rates and can help avoid an inverted yield curve. The economic consequences of sanctions and the war in Ukraine also make the Fed’s job more challenging. Sanctions restrain trade, increasing costs while slowing the economy. The projections for GDP growth in 2022 were justifiably reduced to 2.8% from the prediction of 4% in December as economists recognized the impact of the rate hikes.

We’ll likely see continued short-term rates move closer to the yields on long-term bonds, as short-term rates respond to Fed action while the market gauges whether the Fed is tightening too quickly. The intention to raise rates so significantly increases the risk that the economy can’t handle the rapid rise and heads into recession.

The Fed talked a pretty strong game last week, but the policy increases are gradual and thus conditional on how the economy performs. While the Fed is committed to raising rates if inflation remains high, it would prefer no new government stimulus, supply chain improvements, a transfer of purchases from goods to services and more people willing to return to the workforce. The more those items go the Fed’s way, the less likely it will raise rates as rapidly.

The Fed meets about every six weeks. Weeks when there is a Fed meeting could be more volatile as there is lot riding on the Fed charting the right course during this difficult time.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

https://www.cnbc.com/2022/03/16/federal-reserve-meeting.html

https://www.census.gov/retail/marts/www/marts_current.pdf

Compliance Case #01310080